The Climate of Insurance

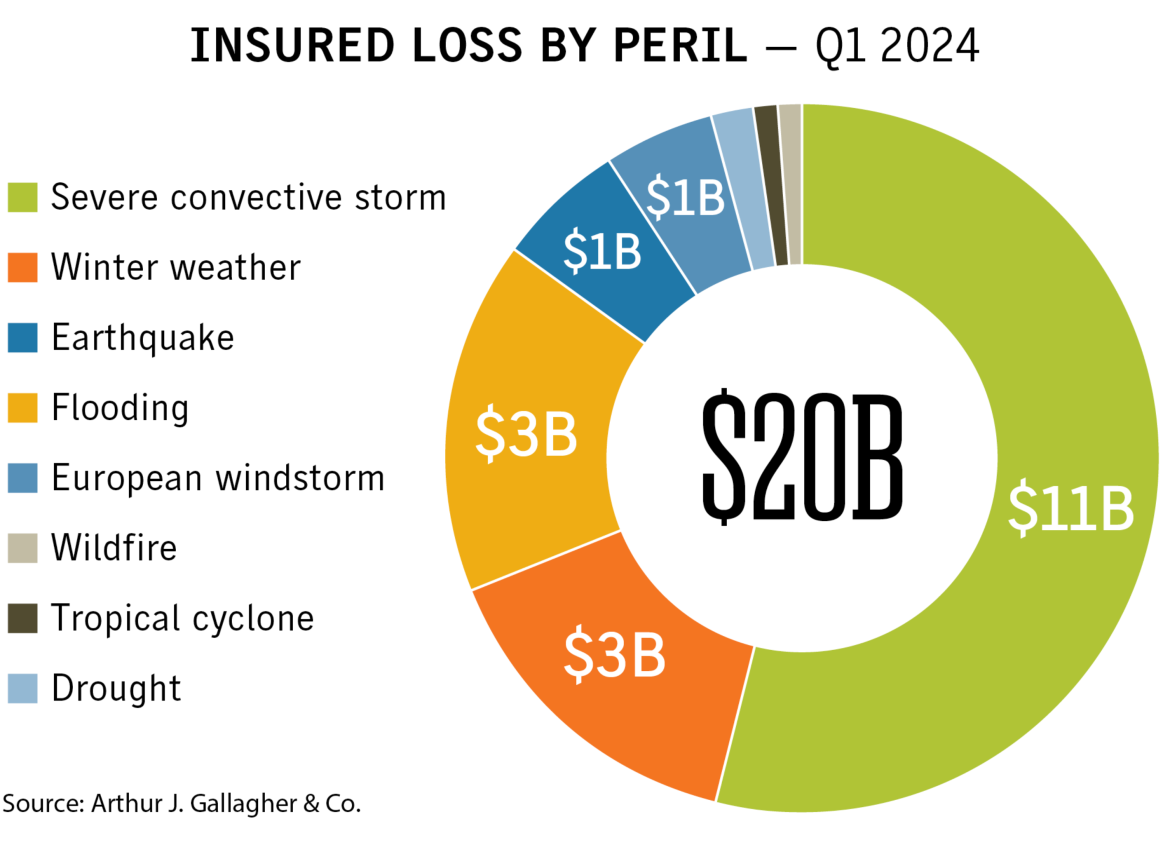

Recent weather-related headlines punctuate an accelerating economic trend: the climate of the private insurance industry is rapidly changing and risk averse. As such, Local 600 member communities and the wider IATSE family of unions are being impacted by national insurance trends that are already augmenting cost-of-living expenses and financial risk.

The insurance industry is a leading researcher of physical, climate and economic risks for property and businesses. Using ever more sophisticated climate modeling and data analytics, insurers can predict, with growing accuracy, the likelihood of insured losses based on financial trends, geospatial data and global climate and weather forecasting from sources like the National Oceanic and Atmospheric Administration (NOAA). Consequently, certain areas of the country are facing insurability issues. Private insurers are raising rates, declining or refusing policy renewals and or exiting certain markets all together leaving some communities with high peril risks up the proverbial creek without an affordable insurance paddle other than state-sponsored insurers of last resort.

According to Natural Disasters and the Homeowners Insurance Market, a June 2024 Congressional Research Service report used by lawmakers to inform elected officials and federal policy, “the U.S. homeowners insurance industry has experienced net underwriting losses in all but one year since 2017, and over the past decade insurers have paid out more in claims than they received in premiums.” This report goes on to specifically outline the causes: inflationary and interest rate realities combined with “rapid expansion of population into areas susceptible to natural disasters, increasing replacement costs, higher reinsurance costs, inadequate building codes, and climatological and environmental changes.”

Insurers are in the business to provide a profitable risk management service to customers but homeowner insurers in 18 states lost money in 2023. That is exactly

why State Farm announced earlier in 2024 that it will no longer offer nor renew roughly 42,000 commercial apartment policies, and similarly will not offer or renew 30,000 homeowners, rental dwelling, and other business property insurance policies. This also includes HOAs and business owners in California. Other insurers, including Farmers Insurance, United Services Automobile Association (USAA), Allstate, and The Hartford announced similar withdrawals or limitation of property coverage for their California policy holders.

Other coastal and inland states including Florida, Hawaii, Texas, Louisiana, Colorado, Illinois and Iowa are similarly in limbo but not just because of a lack of affordable insurance. The valuations of millions of properties in the US do not accurately reflect real estate climate and mortgage risks at present or into the coming decades.

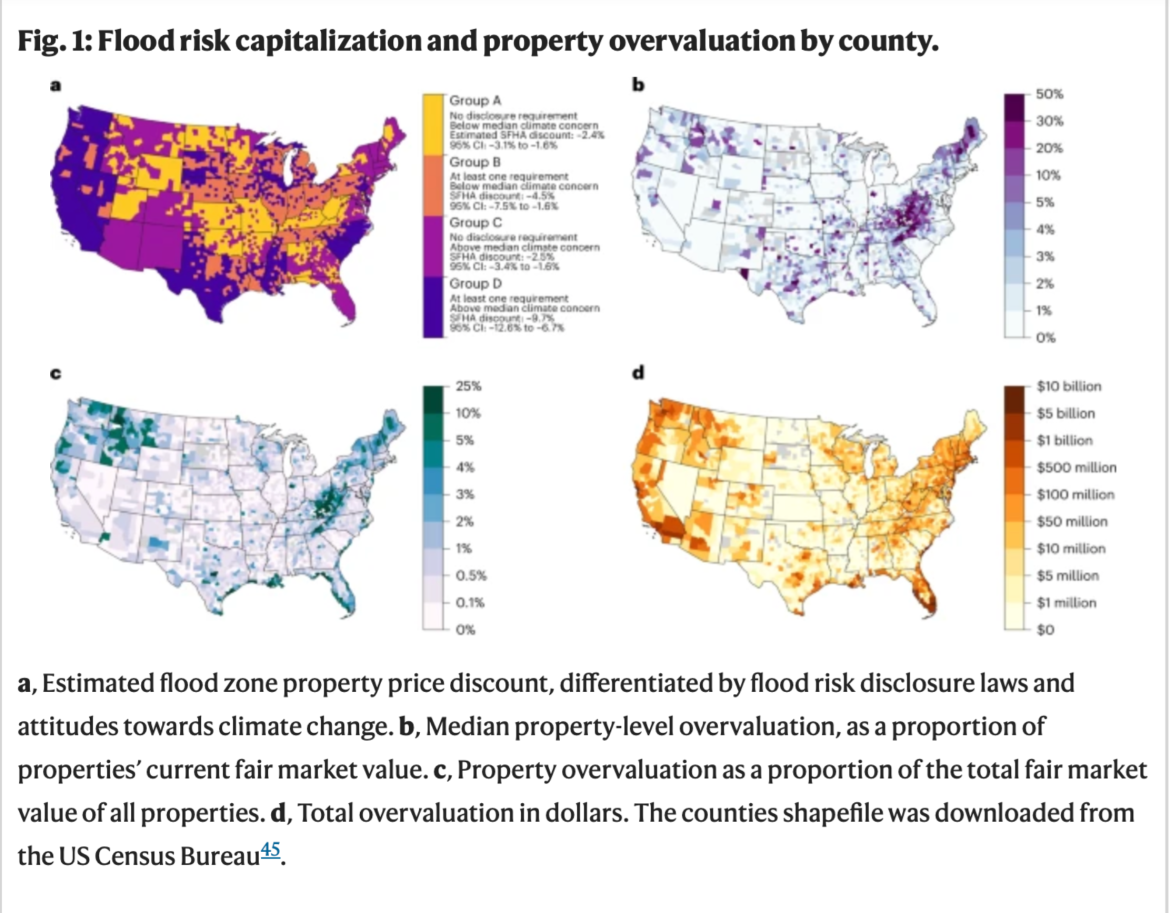

Overpriced Climate real estate bubble Fig. 1

According to First Street Foundation’s 9th National Risk Assessment, about 25 percent of all US homes are at risk of wind, flood and or fire damage which have not adequately priced the cost of climate into property valuations. “The unrealized climate corrected valuation gap represents a growing climate bubble which is just starting to

be recognized and quantified.”

A 2024 Nature Climate Change journal study estimates “residential properties exposed to flood risk are overvalued by US$121–US$237 billion, depending on the discount rate,” and “highly overvalued properties are concentrated in counties along the coast with no flood risk disclosure laws and where there is less concern about climate change.” Overvalued properties that cannot be insured and or can only be insured by expensive state regulated insurers of last resort will likely become stranded assets negatively impacting owners, municipal tax bases, and real estate markets across the country and globe. This is already happening in cities like Miami where property values continue to rise despite climate modeling predicting 30 plus days of flooding a year by 2050.

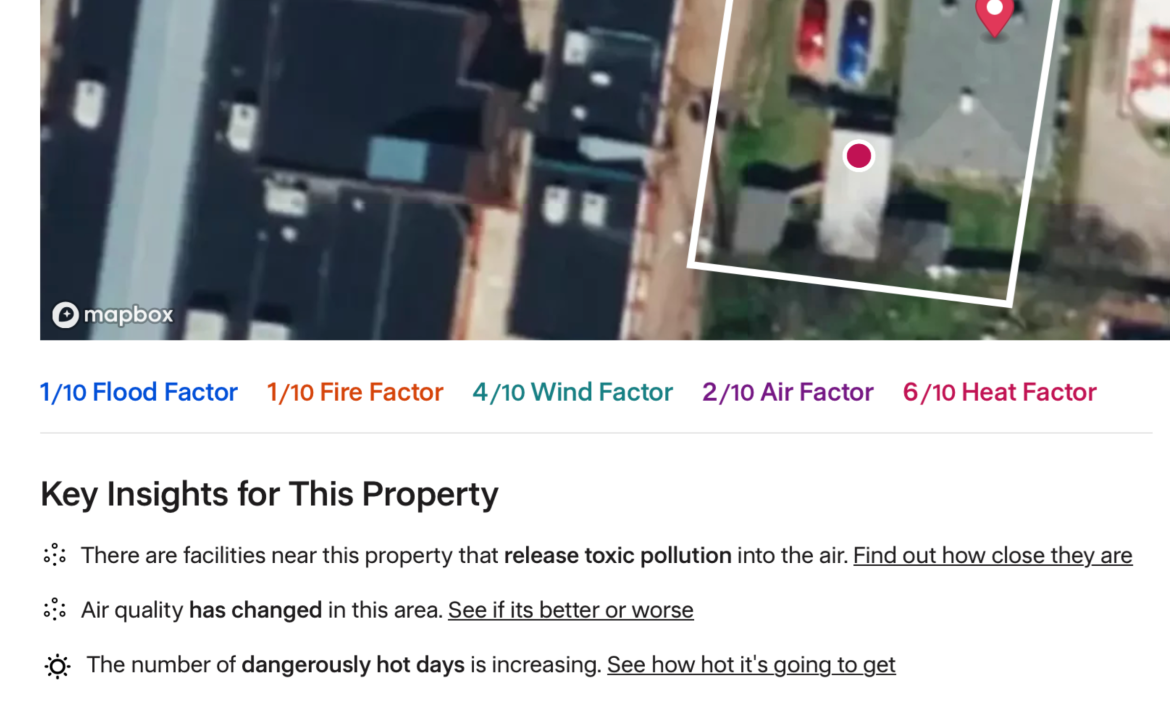

What can members do to take action? Research your property’s climate risk profile. First Street Foundation's Risk Factor website democratizes this information for free by offering private property risk profiles for wildfire, flood, wind, air and heat factor. In the top left corner of the webpage enter a residential address for the risk factor assessment.

Next, be proactive and contact your renter’s, homeowner or HOA’s insurance company and ask if there will be any changes in your coverage for 2025 or before your renewal policy period ends so you can budget accordingly or make carrier changes. If you are a renter, ask your landlord if they have property insurance that covers the dwelling replacement and climate risks. If they don’t, factor that into your contents coverage.

Finally, vote in every single election and speak to your local and state elected officials about your situation related to climate and insurance risk. According to the Environmental Voter Project, nothing motivates policy change and climate leadership like a voter constituency that consistently votes. The climate of the insurance industry has real world consequences now and well into the future. The more informed and proactive we are as union members, the better we can protect our homes, communities and livelihoods for the longterm.